Markets

Shifting Perspectives: The Top Financial Centers in the World

Shifting Perspectives: The World’s Top Financial Centers

Financial centers are catalysts for global growth, with tremendous economic influence.

Historically, the rise of nations has coincided with the emergence of robust financial hubs. From London towering in the 19th century, to New York City gaining dominance in the 20th century, broader economic shifts are at play.

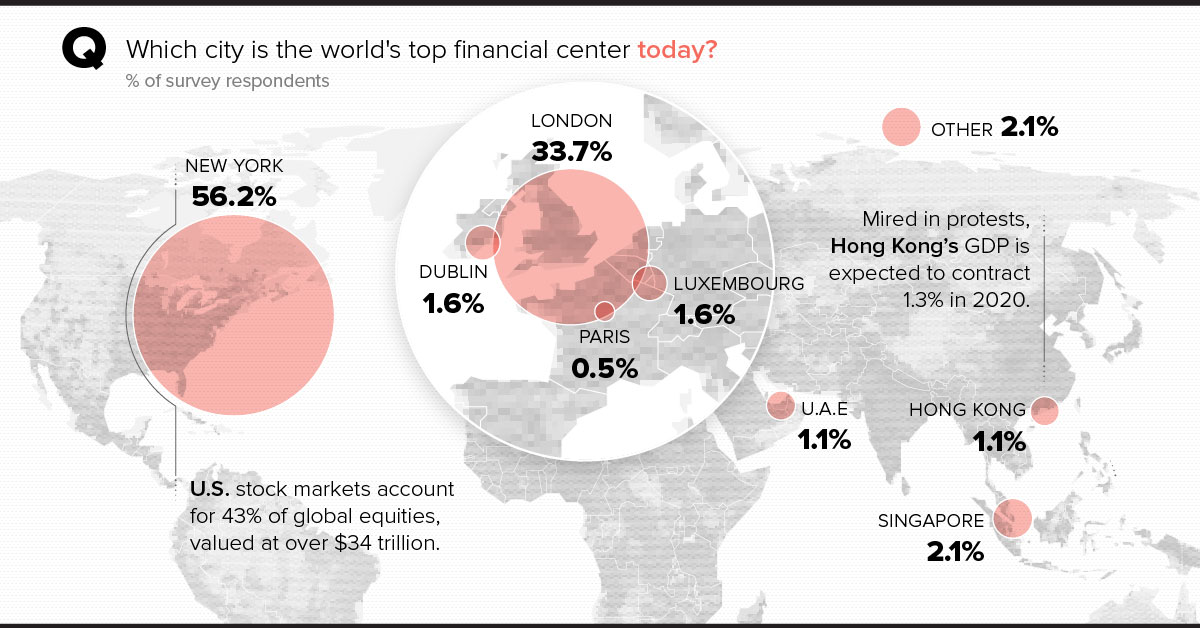

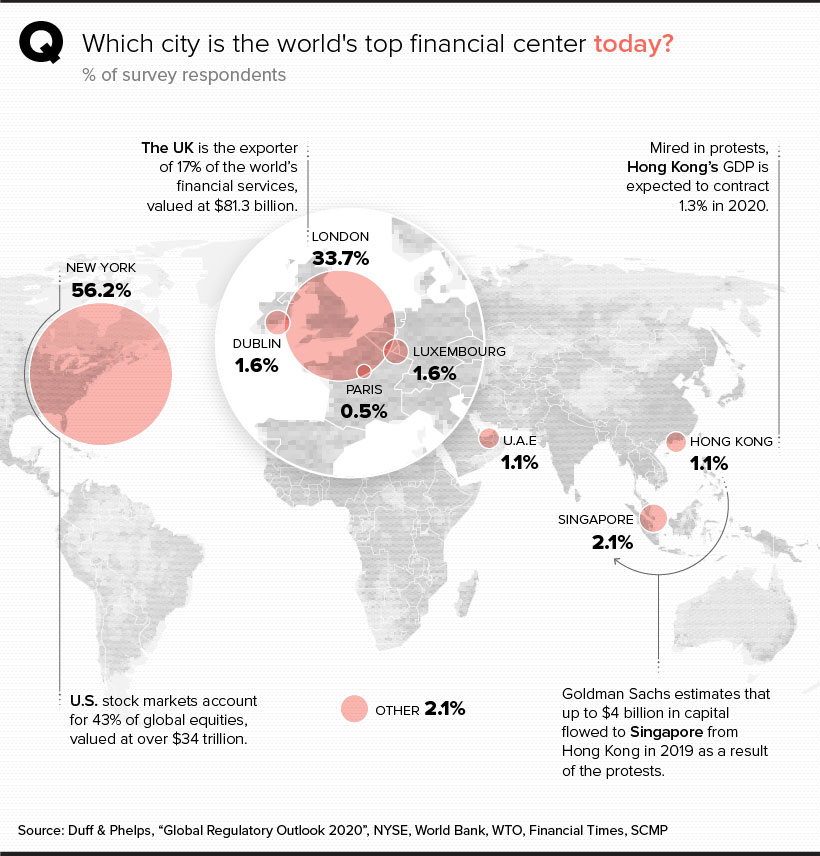

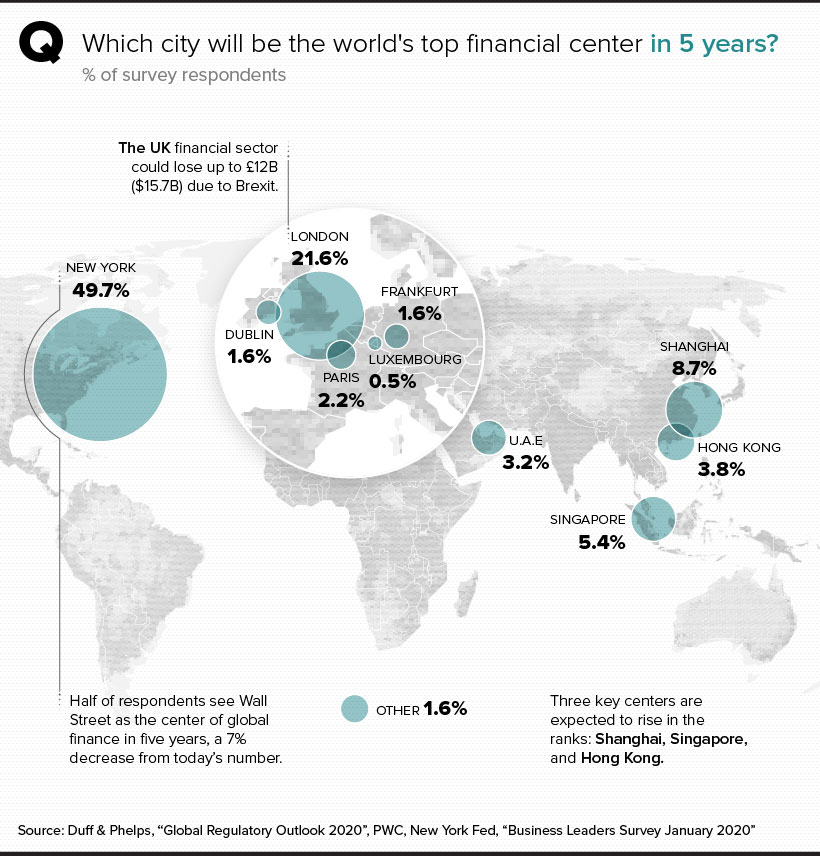

Today’s chart uses data from the Duff & Phelps Global Regulatory Outlook 2020, and it highlights changing perceptions on the world’s financial centers.

In total, 240 senior financial executives were surveyed—we take a look at their responses, as well as key factors that could impact perspectives across the wider financial landscape.

Financial Hubs Today

In the below graphic, you can see the percentage of respondents that voted for each city as the world’s preeminent financial center:

The Status Quo

New York and London are perceived to be at the helm of the financial world today.

New York City is home to the two largest stock exchanges in the world—and altogether, U.S. stock markets account for an impressive 43% of global equities, valued at over $34 trillion. Of course, New York is also home to many of the world’s investment banks, hedge funds, private equity firms, and global credit rating agencies.

Across the pond, the London Stock Exchange has surpassed $5 trillion in market capitalization, and the city has been a global financial hub since the LSE was founded more than 200 years ago.

Together, the United States and the United Kingdom account for 40% of the world’s financial exports. But while New York City and London have a foothold on international finance, other key financial centers have also established themselves.

Rising in the East

Singapore, accounting for 2.1% of the respondents’ vote, is considered the best place to conduct business in the world.

Meanwhile, seventh-ranked Hong Kong is regarded highly for its separation of executive, judiciary, and legislative powers.

Despite ongoing protests—which have resulted in an estimated $4 billion outflow of funds to Singapore—it maintains its status as a vital financial hub globally.

Where are Financial Centers Heading?

A number of core financial hubs are anticipated to underpin the future of finance.

Although New York maintains the top spot, some executives surveyed believe that the top financial center could shift to Shanghai, Singapore, or Hong Kong.

Growth in Asian Hubs

According to survey results, 8.7% of respondents said Shanghai is predicted to be the next global financial hub by 2025. Shanghai houses the largest stock exchange in China, the Shanghai Stock Exchange (SSE), and the SSE Composite tracks the performance of over 1,600 listings with $4.9 trillion in combined market capitalization.

Meanwhile, Singapore accounted for 5.4% of the respondents’ vote. Exporting $27.2 billion in financial services annually, Singapore’s economy has grown at an average clip of 7.7.% per year since the country’s independence, one of the highest growth rates in the world.

The Impending Impact of Brexit

After four tumultuous years, Britain’s departure from Europe took place on January 31, 2020.

Despite a long-awaited victory for the Conservative government, many experts are saying that economic prospects for the region look dim.

We now know that the economy will be between 2—6% smaller in 10 years than it would otherwise have been.

– Ray Burrell, Professor at Brunel University

The UK financial sector could lose over $15 billion (£12B) due to Brexit, and falling investment in the private sector may lead to wage pressure and layoffs.

On the flip side, 51% of UK businesses said that Brexit will be beneficial to business conditions.

A New Paradigm

Although the global financial sector is primarily influenced today by New York City and London, it seems that perceptions are shifting.

While both of these cities will maintain their reputations as massive financial capitals going forward, it’s also clear that hubs such as Singapore, Hong Kong, and Shanghai will be providing some stiff competition for capital.

Markets

The World’s Fastest Growing Emerging Markets (2024-2029 Forecast)

Here are the emerging markets with the fastest projected growth rates over the next five years based on analysis from the IMF.

The World’s Fastest Growing Emerging Markets (2024-2029)

Large emerging markets are forecast to play a greater role in powering global economic growth in the future, driven by demographic shifts and a growing consumer class.

At the same time, many smaller nations are projected to see their economies grow at double the global average over the next five years due to rich natural resource deposits among other factors. That said, elevated debt levels do present risks to future economic activity.

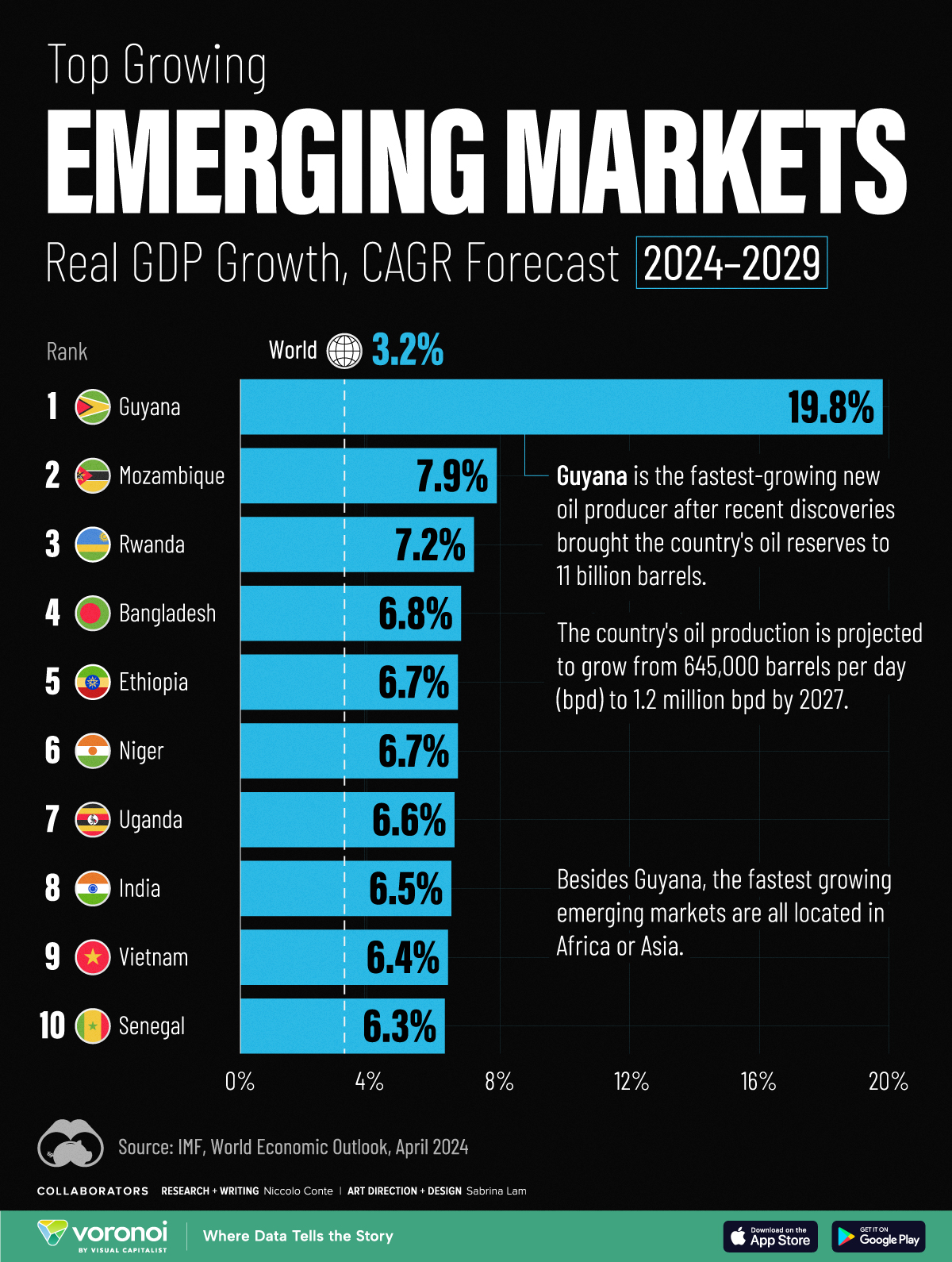

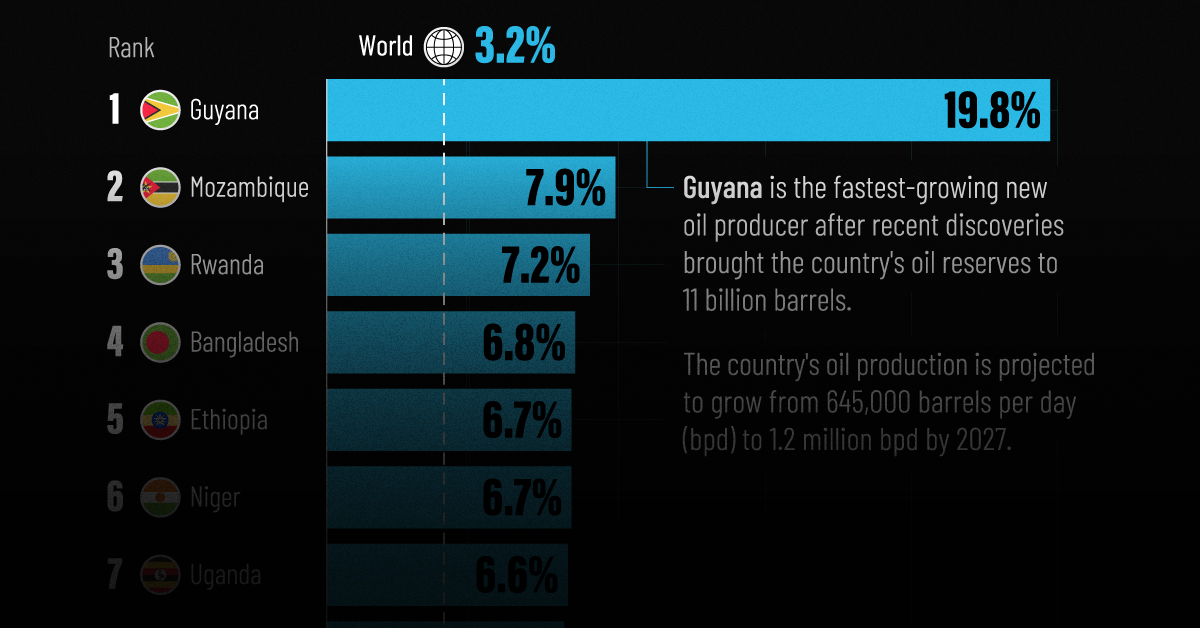

This graphic shows the emerging markets with the fastest projected growth through to 2029, based on data from the International Monetary Fund’s 2024 World Economic Outlook.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Top 10 Emerging Markets

Here are the fastest-growing emerging economies, based on real GDP compound annual growth rate (CAGR) forecasts over the period of 2024-2029:

| Rank | Country | Projected CAGR (2024-2029) |

|---|---|---|

| 1 | 🇬🇾 Guyana | 19.8% |

| 2 | 🇲🇿 Mozambique | 7.9% |

| 3 | 🇷🇼 Rwanda | 7.2% |

| 4 | 🇧🇩 Bangladesh | 6.8% |

| 5 | 🇪🇹 Ethiopia | 6.7% |

| 6 | 🇳🇪 Niger | 6.7% |

| 7 | 🇺🇬 Uganda | 6.6% |

| 8 | 🇮🇳 India | 6.5% |

| 9 | 🇻🇳 Vietnam | 6.4% |

| 10 | 🇸🇳 Senegal | 6.3% |

As South America’s third-smallest nation by land area, Guyana is projected to be the world’s fastest growing economy from now to 2029.

This is thanks to a significant discovery of oil deposits in 2015 by ExxonMobil, which has propelled the country’s economy to grow by fourfold over the last five years alone. By 2028, the nation of just 800,000 people is projected to have the highest crude oil production per capita, outpacing Kuwait for the first time.

Bangladesh, where 85% of exports are driven by the textiles industry, is forecast to see the strongest growth in Asia. In fact, over the last 30 years, the country of 170 million people has not had a single year of negative growth.

In eighth place overall is India, projected to achieve a 6.5% CAGR in real GDP through to 2029. This growth is forecast to be fueled by population trends, public investment, and strong consumer demand.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Green6 days ago

Green6 days agoThe Carbon Footprint of Major Travel Methods

-

Misc2 weeks ago

Misc2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands2 weeks ago

Brands2 weeks agoHow Tech Logos Have Evolved Over Time

-

Energy1 week ago

Energy1 week agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Demographics1 week ago

Demographics1 week agoCountries With the Largest Happiness Gains Since 2010

Can I share this graphic?

Can I share this graphic? When do I need a license?

When do I need a license? Interested in this piece?

Interested in this piece?